Opening a bank account as soon as possible is one of the important things. A bank account will have several uses for you:

Depositing cash assets in a safe place

Record keeping and recording revenues and expenses (receipts and payments)

Pay bills like rent, electricity bill, phone bill, etc.

Receive funds directly from some employers or government services

Create a track record in Canada, which can be useful for getting a loan or getting a credit card in the future.

Types of bank accounts

Different banking institutions usually offer various offers to open an account. The variety of accounts and their monthly fees, the cost of banking operations and the amount of bank interest varies from institution to institution.

Common bank accounts include:

The types of bank accounts and their applications are listed in below.

Chequing account: This account is one of the types of bank accounts in Canada that is used to withdraw, purchase and perform daily tasks. Also, a check is issued for this type of account.

Saving account: This is a Canadian dollar savings account with a small interest rate and a fee for withdrawing money from this account.

USD Saving account: The savings account is in US dollars and earns little profit.

Credit Card account: This account is a credit account used for daily and online purchases. This account consumes your credit in the bank, so you have to pay your debt every month in the next month, up to the date specified by the bank, otherwise a high interest rate will be added to your debt and your credit with the bank It gets damaged.

Monthly costs

Banking is free for students and people over 60 get a lot of discounts. Bank charges are also free for newcomers to Canada but only for a limited time. Upon expiration, you will have to pay a monthly fee of up to C $ 30. Many banks waive this fee if they have a minimum amount in their account.

Transaction costs

On many accounts you will only have a limited number of free transactions per month. Anything outside of this set amount costs (about $ 1 per transaction). Some accounts have unlimited transactions. However, these accounts usually have the highest monthly costs and the highest minimum balance requirements in order to waive the cost.

Withdrawal fees from ATMs

Cash withdrawal from an ATM is free if you use your bank teller, but if you use another bank ATM, it costs about $ 1.50 per transaction.

Worse, withdrawing from an overseas ATM may cost around C $ 5 plus a 2.5% commission.

International transfer costs

All major banks in Canada Newcomer Packages have a limited number of free international transfers.

However, even though it is advertised that these transfers will be free, in many cases you will actually have to pay a fee when you make the transfer and come back at another time. Other terms and conditions may apply, so you should read the text carefully before deciding to use this service.

VOID CHECK

A check is a blank check on which the word VOID is written in large and clear letters. Doing so will invalidate your check and no one else can fill in the blanks and withdraw from your account.

Below the wad check there are 3 numbers that are used in many cases.

When a person wants to create an electronic link between his / her bank account and your bank account, he / she uses a check.

When you go to the bank, to get a check, be sure to bring 2 pieces of photo ID with you.

What is a bank statement?

Bank statement is your transaction that you do every month. To receive this document, you can go to the bank and request a printout from the bank clerk.

When you ask the bank teller to print your account, he asks you in what period do you want to print your account?

For most cases, it takes 3 or 6 months to print the account. When you ask the bank to print your account, be sure to ask them to stamp the bank and the date of the day on all pages.

An easier way to get an account print online is that you can log in to your Online Banking account and click on the Bank statement option (this name may change slightly in different banks and applications). Then you choose the period you need, for example, the last 6 months or from February to March, and then you can download your printout in PDF format.

Mobile payment upon purchase

In Canada, card readers can be used in two ways:

- Insert the card into the device and then enter the password that there is no purchase limit in this method.

- Tap the card on the card reader and tap Tap the card, this way you are only allowed to buy up to $ 100 and if your purchase is more than $ 100, you must enter your card and enter the password. hit.

There is an application in smartphones where you can enter your banking information and your phone acts like a bank card, and when you want to pay, just enter the Apple Pay or Samsung pay application and after selecting the bank card You (debit card or credit card) place the phone near the card reader and payment is done automatically.

List of major banks in Canada:

In the table below, you can see the names of the banks, as well as their abbreviated words and the website of each bank.

| Bank name | Abbreviation name of the bank | The official website of the bank |

|---|---|---|

| Royal Bank of Canada | RBC Bank | https://www.rbcbank.com/ |

| TD Canada Trust | TD Bank | https://www.td.com/ca/en/personal-banking/ |

| Scotiabank | https://www.scotiabank.com/ca/en/ | |

| Bank of Montreal | BMO Bank | https://www.bmo.com/main/about-bmo/ |

| Canadian Imperial Bank of Commerce | CIBC | https://www.cibc.com/en/personal-banking.html |

- Royal Bank of Canada

Royal Bank of Canada is the largest bank in Canada and offers its customer service in more than 200 languages. The bank also has comprehensive packages for Canadian newcomers. If you have a temporary visa, you can open a bank account without RBC signature restrictions or a special free RBC VIP bank account for 6 months. You will also receive a free credit card.

Once you have permanent residency status, you will be eligible for a car and mortgage loan, even without a credit history. If you are a student, a bank account without RBC restrictions is free for students and will be opened with a free Visa Gold card or MasterCard credit card. Finally, if you own a business or an entrepreneur, you will receive all the benefits of the Canada Newcomers Package plus a $ 50 credit when you start your business deposit account.

- TD

The Canadian Newcomer package at TD Bank Toronto includes a free current account for 6 months and a free credit card with a credit limit of up to C $ 1,000. You may also be eligible for a mortgage if you do not have a credit history.

If you are planning to start a new business, you can get a custom service plan that includes overdraft protection and a number of free monthly transactions.

- Scotiabank

Scotiabank is Canada’s third largest bank and has more than 4,000 ATMs nationwide. The bank has a wide range of types of accounts to choose from and all have their own privileges.

The Student Banking Benefit Scheme has no monthly fees and the number of transactions is unlimited, while a number of Business Bank accounts include overdraft protection up to $ 5,000, a custom business plan and a Visa credit card.

- Bank of Montreal

The oldest bank in Canada is Bank of Montreal and has a package for newcomers that covers the workforce, students and business owners. You will receive up to one year, a bank account with unlimited transactions and no monthly fees, a MasterCard credit card and even a safe deposit box. Even if you have just arrived in Canada and do not yet have a credit history, you may still be eligible for a mortgage.

- Canadian Imperial Bank of Commerce

Like the other four major Canadian banks, CIBC has a plan for Canadian newcomers that is available to both temporary and permanent residents. This package includes a daily CIBC current account with no monthly fees and unlimited transactions for one year and a Visa Debit Card. If you are a permanent resident of Canada, you can have up to C $ 55 in cash at a safe deposit box.

There are also a number of working bank accounts to choose from. These accounts include unlimited transactions, a flexible cost structure depending on the size of the business, and your access to a variety of loans at preferential rates.

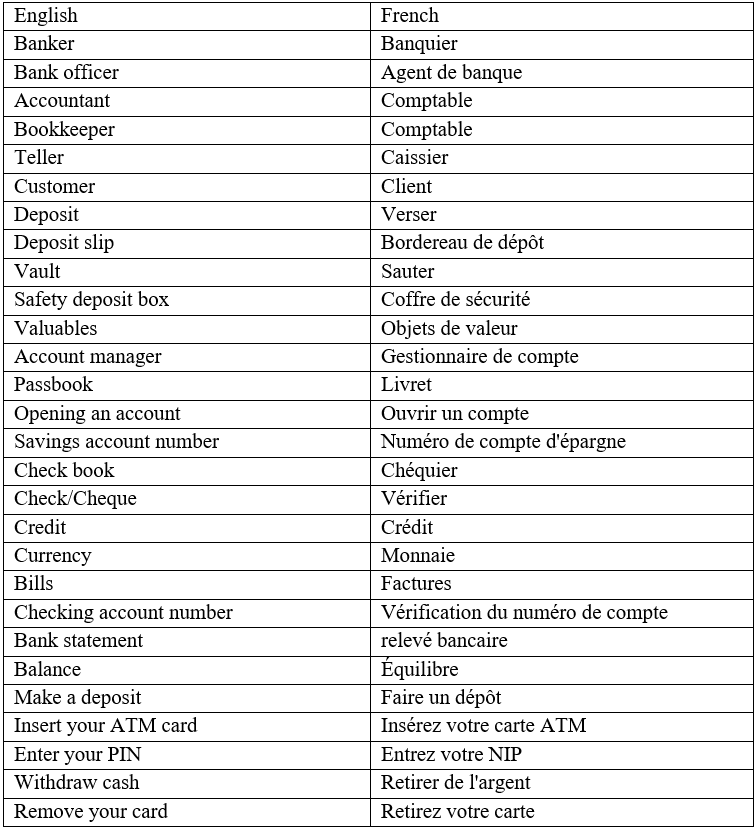

Useful and important words in banking